Learn how to make a budget that is customized just for you, and prioritizes the things that matter most.

Money management is something I’m naturally good at. I have a knack for it, and I even somewhat enjoy it…at least when there’s enough money to work with. But even when money is tight, that’s a great time to create a budget to make sure you aren’t living beyond your means.

MANAGING MONEY

I started working at 15, and as soon as I began managing my own money I found that I was pretty good at it! Back then I had low expenses and fair earnings, so it wasn’t too hard. But when I first got married we found ourselves very tight on money and my skills were put to the test. I have been a stay-at-home mom for almost 5 years now. We manage to get by on a single income in Southern California – the land of overpriced everything! And we still manage to travel and go out to nice dinners regularly.

I’ve managed the finances of a few people close to me and gotten them out of some sticky situations and onto a plan where they are more or less debt free and far from being in financial trouble. So I have experience not just with my own finances, but with some different scenarios when I’ve helped others.

MONEY MANAGEMENT SERIES

I’ve hesitated to approach this topic because, although I’m excited to share my methods and hopefully make a difference in somebody’s life, I want to make sure I can communicate all of the stuff that’s in my brain in an organized fashion. So, I’m breaking it down into smaller posts so I can focus on doing just that. Over the next few months there will be more and more finance and budgeting posts peppered throughout my new content for you guys. I even have tentative plans to put it all together in greater detail into a full money management course, but we shall see if/when I get to that. Let me know in the comments if that’s something you would be interested in!

WHY YOU SHOULD MAKE A BUDGET

Making a budget keeps you on track so you don’t end up short at the end of the week. Multiple weeks where you are spending more than you’re bringing in turn into months where you are overspending. Months of overspending can very easily become debt that continues to accrue. Often this is the sort of debt you just can’t get out from under because you’re still overspending and then have no extra money to pay the debt down with.

Making a budget also aids you in making financial decisions. If you’re on a budget you will know exactly how much of a car payment you can comfortably afford. You’ll know how long it will be until you can afford that trip to Europe, AND it will make that trip attainable!

If you find yourself a little (or a lot) short on money here and there, a budget can make all the difference. If you’re fortunate enough that you have money to spare, making a budget can take your money management to the next level and help you save for those bigger purchases. It can help prevent you from letting too much money slip through your fingers.

HOW TO MAKE A BUDGET

So – how to make a budget. Creating a budget seems to be the first logical step to taking control of your finances. However, it can also be a daunting thing to do. You can’t use somebody else’s pre-made budget, because their income and expenses will never be exactly the same as yours. Perhaps you could go roughly off of percentages, but that can also end up being WAY off. It doesn’t take your income or personal priorities or expenses into consideration. That leaves many people unsure of where to start, so they give up before they begin. Read on and I’ll show you how to make a budget easily and quickly.

First, you need to figure out where your money is going. Many of us tend to use either a credit or debit card for most of our purchases. A really easy way to do it is to go back through those statements and look at what you’ve BEEN spending. Take the items and put them into categories of like kinds. If by chance you do use cash a lot, you may need to simultaneously observe your spending while trying to categorize your budget.

EXAMPLES OF PERSONAL BUDGET CATEGORIES

You’ll want to create a category for each of your monthly bills (gas company, water/power, mortgage/rent, car payment, insurance, phone bill, etc.).

Also create categories for the items you spend money on regularly (groceries, dining out, household expenses like paper towels or new decor, entertainment, etc.).

Create a category for any debt you have that you didn’t cover in your monthly bills (student loans, credit card debt, etc.).

For items that don’t really need their own category, try to figure out what broader category they could fit under (such as home supplies, groceries, child necessities, mad money, etc.)

For more indulgent or self serving purchases, I recommend creating a “mad money” category for each adult in the household. Add up the total that each adult is usually spending and lump it all into that category. I’ll be doing a future post on why I believe adults should get an allowance (in a good way). But for now, just tally it all up and realize that although these items can probably be cut back on, eliminating them completely is probably unrealistic.

Go back through at least a couple of months. The more data you collect for this the more accurate your budget will be from the beginning. Either way, you can adjust your budget as necessary once you get a feel for how it’s working for you.

SHOULD I HAVE A MONTHLY OR WEEKLY BUDGET?

Most of us don’t pay our bills or receive income monthly, so our budget shouldn’t be monthly either. I recommend that you make your budget weekly no matter what increment you receive income on. Otherwise you may blow your whole budget for a certain category and have to wait for weeks before it is “reloaded”. That’s the kind of thing that sets you up for overspending. It’s sort of like removing all the cookies from the house before you start a diet – you have to remove as much overspending temptation as possible.

HOW TO MAKE A WEEKLY BUDGET

Now divide everything up so it’s broken down by week. If it’s a monthly expense, divide it by 4 (because there are 4 weeks in most months). If it is a weekly expense such as gas or groceries, add them up and get an average of how much you’re spending.

Next, total up your income (by average if necessary), and figure out what your average weekly income is.

When you are in a 5 week month, there will be many expenses that you still need to allot money for on a weekly basis. They will mainly be weekly expenses such as gas, groceries, etc. However, any monthly expenses that you divided by 4 will not need to be covered during that 5th week. Consider it an opportunity to play catch up if you’ve gone off budget, or an opportunity to pad your bank account for unexpected expenses if you’re right on track.

HOW TO MAKE SURE YOUR BUDGET IS BALANCED

Next, you need to add up all of your different categories/weekly expenses. Then add up your weekly income. Now make sure your income total is equal to or greater than your expense total. It’s as simple as that.

Your money going out every week needs to be less than the amount you’re bringing in.

If the amount going out is more than the amount coming in, you need to look at your categories and see where you can trim the fat. Keep cutting until you have the same or less money going out than you have coming in. Often when we see exactly how much certain things are costing it becomes an easy decision. I’ll have a post coming up where I give you a bunch of easy ways to cut back too.

There are so many nuances to this such as annual expenses or expensive holidays like Christmas etc. I’ll be getting into all of that in the future, so watch out for those posts. We’ll also be dealing with methods to get OUT of debt if you’re already buried under credit card payments. I have a method to address all of those issues. But for now, we’re just trying to get a handle on creating a budget. This is the framework for it all.

PERSONAL BUDGET EXAMPLE

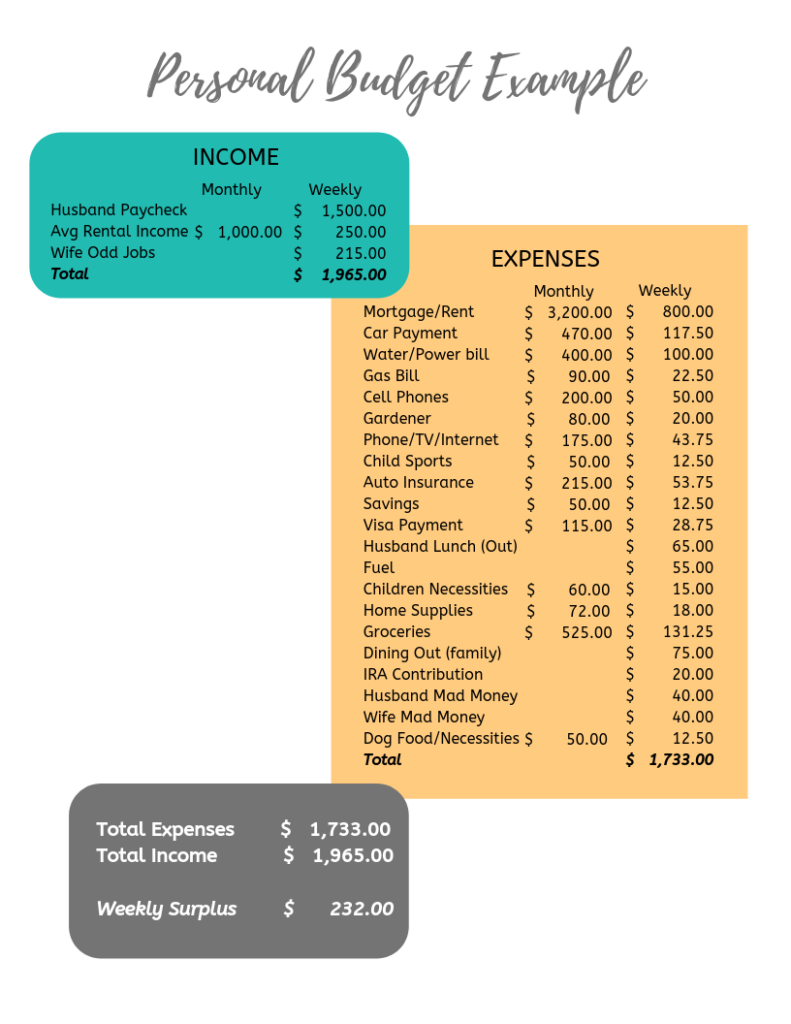

Here’s an example of a personal budget with all income and expenses broken down by week. You can see where there was a monthly bill that was then divided by 4 to find a weekly amount, and also where the expense was a weekly expense to begin with. You’ll notice this example has a surplus of $232 per week.

Budgeting isn’t mystical or magical – it’s math. You need to be “in the black” as they say each week. Otherwise your small weekly shortages will turn into larger monthly shortages, which turn into debt. Likewise, small weekly surpluses can be turned into large surpluses that can be leveraged for big things. The example above reflects only a couple hundred dollars extra per week. It’s an amount that could easily be spent on an extra meal out and subscribing to the movie channels on your TV service. OR you can stay on budget and have $12,064 saved up by the end of a year!!!

CUSTOMIZED PERSONAL BUDGET

There you go! You have your customized budget! Now make sure you write it down and stick with it! I recommend a cash budget. In a future post I’m going to be sharing with you my cash budget system. It is slightly similar to Dave Ramsey’s envelope system. However, it doesn’t have you fumbling with a bunch of envelopes or trying to stop and write things down as you’re spending. It’s very doable – I promise.

HOW TO MAKE A BUDGET VIDEO

PIN IT FOR LATER

Thanks for stopping by!!

XO,

Morgan

The Cheeky Homemaker

Leave a Reply