With this weekly savings plan, learn to categorize and track your savings for financial success!

This post is all about tracking your weekly savings plan. If you don’t already know what exactly should be in your weekly savings plan, you most likely missed part 1 of this post! You don’t want to miss it, because it is the key to staying out of debt!! You can find it HERE.

Alright. So we left off with a bunch of categories we’re saving money weekly for. Now what? Where do you put that money, and how do you remember what’s for what? Read on dear friends. All the answers are below.

WHERE TO KEEP YOUR WEEKLY SAVINGS

Now that you know how much you need to save each week, you’ll need to keep track of it. First you’ll need to decide where you’re going to keep the money. Here are some options:

- Savings Account: This is a great option for expenses that only come up once or twice a year. It works out well to set up an automatic transfer from your checking to your savings account so the money automatically gets set aside. Then you just need to track it each month when you see the transaction happen. PLUS this can save you on bank fees, because many banks reward you for automatic transfers to savings.

- Checking Account: For expenses where you need to access the money more quickly like gift giving, it can make sense to keep the money in your checking account. If you make too many transfers between your checking and savings account per month, some banks will charge you fees. Keeping your more frequently used money in your checking account can help avoid that.

- Cold Hard Cash: For those of you who prefer to use a cash budget (I’m one of them), it can sometimes makes sense to go old fashioned and stash the cash somewhere in your home. I personally don’t do this, because we don’t have a fireproof safe and I just don’t feel comfortable with it. But if you do, by all means go for it! This is the easiest way to track it, because you just put the cash in a labeled envelope and tuck it away. You won’t need to consider it when you balance your accounts or keep a paper trail, because you can just go count your cash!

TRACKING YOUR WEEKLY SAVINGS

If you’ve chosen to keep your saved money in your bank account, then you’ll need to track it. You have a couple options for how to do that.

HOW TO TRACK YOUR WEEKLY SAVINGS ON PAPER

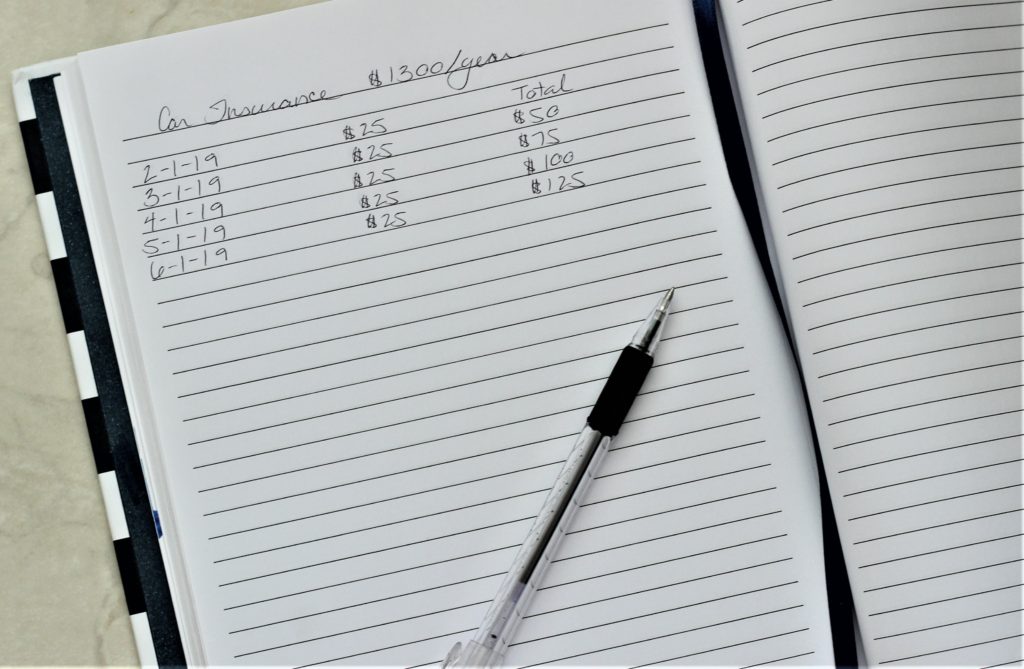

I prefer to dedicate a notebook to this.

- Dedicate a page spread to each category. You’ll want to have plenty of room for all your future entries.

- Enter the date and amount of each entry per category. So if you’re setting aside $25/week for car insurance, you would go to your Car Insurance page and write the date and your $25 entry

- Keep a running total of all the entries. When you add the current entry of $25, you’ll want a column at the far right where you add that $25 to the grand total of your car insurance money from all previous entries.

- When you need to pay your car insurance, you can either start a new page, or you can simply show the payment as a negative transaction. Either way, don’t forget to adjust your running total to reflect whatever you have leftover (if any), and keep going for the next bill.

- It is very important to know if the money for each category is in your savings or checking account. You’ll see why later.

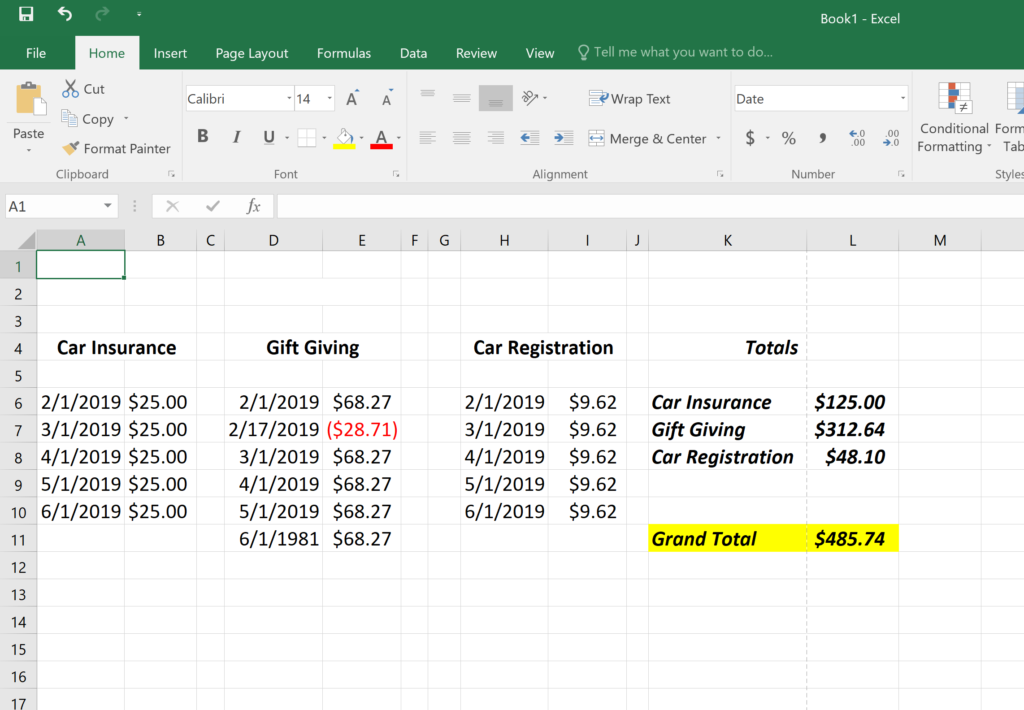

HOW TO TRACK YOUR WEEKLY SAVINGS IN MICROSOFT EXCEL

If you know how to use Microsoft Excel (or any program that works similarly), that will be the easiest way to go. The reason it is so helpful is because you can set the formulas to total things for you.

- Create a different page/worksheet for each account you’re saving money in. So if you’re using both checking and savings for different categories, you’ll want to keep those separate. You’ll see why later.

- Create columns for each category.

- Enter the date and the amount your are contributing under the proper heading for each category.

- Create a formula to total each category for you

- Create a formula to give you a grand total of all of the totals (from each category) on that page

- As you use money in any given category, simply enter the date and a negative amount so it will be subtracted automatically

PRESERVING YOUR WEEKLY SAVINGS

Now that you’re tracking everything, you need to make sure you don’t accidentally spend the money you’re setting aside weekly. Here’s how to do that for each account:

PRESERVING YOUR WEEKLY SAVINGS IN YOUR CHECKING ACCOUNT

Each time you balance your checking account, you’ll need to add up the totals of all the categories you’re saving in that account. If you’re tracking in Excel, you’ll already have a total calculated for you. If you’re tracking in a notebook, you’ll add the running totals up.

$125 Car Insurance

+ $312.64 Gift Giving

+ whatever else

= Your Grand Total

Now subtract the grand total from your checking account balance. You’ll need to do this to get your adjusted total of the money in your account for spending. You need to pretend the money for your weekly savings is not there as you balance your accounts. Otherwise it will get lumped into your bill paying money and you’ll think you have an excess.

If this sounds too difficult to you (and that’s fair – I call it playing monopoly because it has a bunch of moving parts), then don’t save money in your checking account. Transfer it to savings or save it in cash instead.

PRESERVING YOUR WEEKLY SAVINGS IN YOUR SAVINGS ACCOUNT

If you have any other money in your savings account, simply make a page (or columns in Excel) for it.

Then all you have to do is add up all your running totals (or let Excel do it for you), and this number should match your savings account balance.

It is much more simple to keep track of your weekly savings in your savings account, because it is more simple to balance it this way.

HOW MANY SAVINGS ACCOUNTS SHOULD I HAVE?

There are some out there who use my same method of setting aside money for different categories, but they recommend you open a savings account for each category to keep everything straight. I don’t think that’s a great idea for a couple of reasons.

First, whether the money is in its own account or all in one account, you still need to track what it is for. If each category has its own account, you’ll have account numbers and bank statements to track also. If you put it all in one main savings account, it keeps it simple and you know where your money is!

Also, banks are charging more and more fees for every little thing these days. It’s sometimes difficult enough to get one free savings account! I couldn’t imagine how much you would pay in fees if you started opening a new account for each category you want to save money for.

Third, some of these categories won’t have that much money saved in them. Can you imagine an entire account that never gets above a balance of $300? That just seems silly to me.

But, each to their own. If you want to open an account for each category, by all means, do you boo. Whatever makes the monopoly game easier and more organized in your brain is the way you will be most successful with it.

SHARING IS CARING

If you are enjoying my finance series, please share it with your friends and family! Use the Facebook or Pinterest links at the top and bottom of the post, send it in an email, put a message in a bottle, or print it and sail it in a paper airplane. Whatever method you choose, I truly appreciate when you share. Knowing the time I took putting this all together has benefited somebody out there makes it all worth it.

RELATED POSTS

HOW TO MAKE A BUDGET

HOW TO BUDGET ON AN IRREGULAR INCOME

WEEKLY SAVINGS PLAN | Part 1

Stay tuned for more episodes in my finance series!!

PIN IT FOR LATER

WEEKLY SAVINGS PLAN | Part 2 | VIDEO

Thanks for stopping by!!

XO,

Morgan

The Cheeky Homemaker

Leave a Reply