Learning to budget on an irregular income can be a little tricky. However, it can be quite simple with the proper system in place.

How do you set a budget for a variable income? By prioritizing and making sure you don’t overspend. I’ll show you below how you can easily budget on an irregular income.

HOW TO MAKE A BUDGET

The first thing you need to do is make a budget. I did a detailed post on this that you can find HERE. It walks you through exactly how to figure out what YOUR budget should be – completely customized to your expenses.

Once you know what your expenses are (and have possibly noticed where you’re overspending), you need to balance things by making sure you’re bringing in enough money each week to cover your expenses. But what do you do if you have an irregular income?

HOW TO BUDGET ON AN IRREGULAR INCOME

When you have an irregular income you need to do two things.

- Make sure you’re not overspending on a regular basis.

- Roll over any excess money to the future so you have it when you have a short week/month.

You could certainly create a spreadsheet in Excel to cover all of this. But if you’re not the spreadsheet type, I have a simple solution for you.

BUDGET THERMOMETER FOR IRREGULAR INCOME

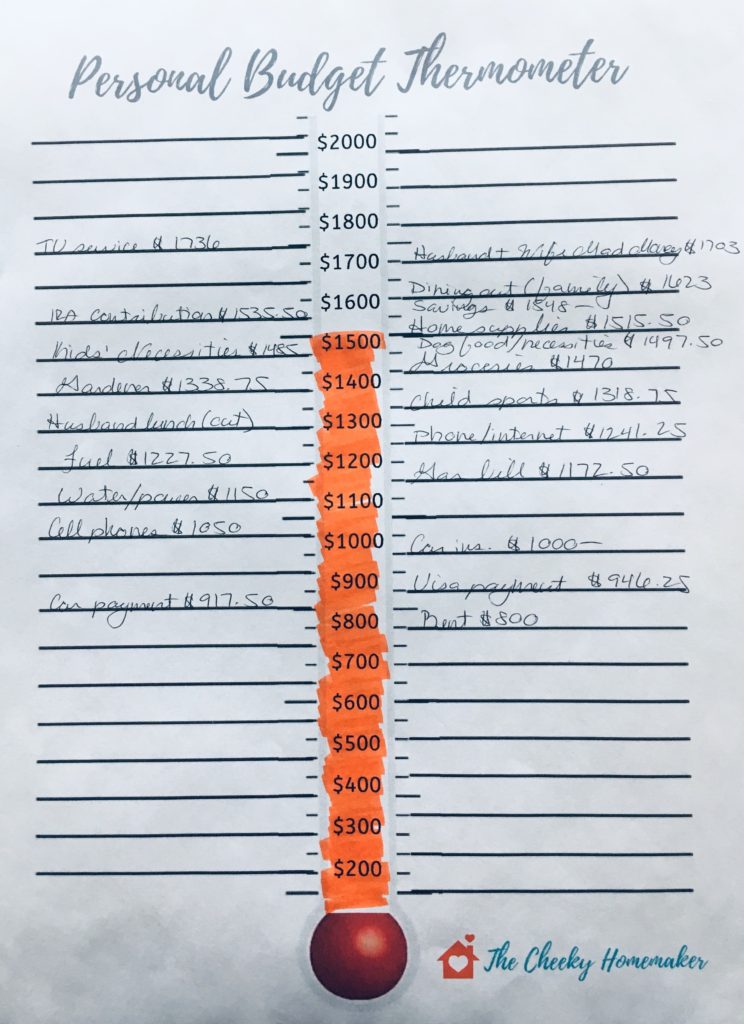

You know those thermometer graphs schools or non-profit organizations create when they’re having a fund raiser? They draw a large thermometer and instead of degrees, they list dollar amounts on the way up. They then color in the graph as they raise money. I’ve adapted this same principle for budgeting on an irregular income.

I’ve created free printables for you to print at home. There are 4 versions – each of them based off of a total weekly amount. Choose whichever one is just a little more than what you normally bring in each week. So if, for example, you normally bring in around $1400/week, you would choose the $2k budget thermometer.

HOW TO PRIORITIZE YOUR EXPENSES

Once you have created your weekly budget (per my other post HERE), and you’ve printed your budget thermometer (link below), it’s time to prioritize your expenses.

To prioritize your expenses, you’ll need to be very honest with yourself. Order your expenses from most important (such as paying your rent/mortgage) to least important. This will vary for everyone. Don’t do it based on what you think your priorities should be, but instead base it on what they actually are. If having money to dine out is more important to you than having cable TV service, so be it! Whatever the case, get each and every item in order.

HOW TO USE THE BUDGET THERMOMETER TO BUDGET ON AN IRREGULAR INCOME

Now it’s time to plug your expenses in to your budget thermometer. For this post I’m going to use the same expenses as I used in my How To Make A Budget Post, so I’ll be using the $2k budget thermometer. This is because my weekly expenses total $1733 and my weekly income totals $1965.

**NOTE: You’ll notice I broke the phone/TV/internet category apart so TV is standalone. I did this because it allows me to prioritize these items the way I want. TV is much less important to me than phone/internet service.

Here’s how I prioritized these expenses:

WEEKLY EXPENSES

Mortgage/Rent $800.00

Car Payment $117.50

Visa Payment $28.75

Auto Insurance $53.75

Cell Phones $50.00

Water/power Bill $100.00

Gas Bill $22.50

Fuel $55.00

Phone/Internet $13.75

Husband Lunch (out) $65.00

Child Sports $12.50

Gardener $20.00

Groceries $131.25

Children Necessities $15.00

Dog food/Necessities $12.50

Home Supplies $18.00

IRA contribution $20.00

Savings $12.50

Dining out (family) $75.00

Husband Mad Money $40.00

Wife Mad Money $40.00

TV $33.00

Let’s talk about how I came up with this prioritization.

- Items that will affect your credit OR are important things you will lose if you’re late should always be top priority.

- Basic necessities should also be near the highest priority.

- After that, it’s up to you!!!

Just make sure you’re completely honest with yourself in the order you prioritize things. Don’t do it based on what you think you should care more about – order them based on what you really value more!

You will be doing a running total as you enter your expenses. With rent being $800 + car payment being $117.50, you will enter “car payment $917.50” on the thermometer. This is because you need $917.50 in order to pay both the rent and car payment. Continue to enter things and do a running total as you enter items next to the appropriate dollar amount (see picture below for visual).

REFLECT YOUR INCOME ON THE BUDGET THERMOMETER

You will be coloring UP the thermometer based on how much income you bring in that week.

If you receive income multiple times per week, you will probably want to color it in as you go. If you prefer to do it weekly OR you only receive income weekly, you can do it once per week. Either way, your thermometer should look something like this once all of your expenses and income are entered.

WHAT ABOUT THE ITEMS YOU CAN’T AFFORD?

Anything above the amount of income you brought in that week you will need to forgo that week. If you regularly can’t afford something that is a subscription service (such as TV in this example), you’ll need to cancel it. Otherwise, you can either earn or pass things on a weekly basis (such as only eating out on weeks that you earn enough income to do so). If you find there are items that are important to you that you regularly can’t afford, you will need to reevaluate your prioritization and the amounts you are spending on items.

I will be doing a post on ways to save money in the future, but for now, just remember that sometimes cutting back the amount you’re spending on several items can keep you from needing to completely eliminate an expense.

WHAT IF I HAVE EXTRA MONEY AFTER I’VE PAID ALL MY EXPENSES?

What to do if you have excess money after you’ve covered all of your expenses? Well first, congratulations! I’m happy for you!!!

Now, after you’re done with your happy dance, please don’t go celebrate with an expensive dinner or purchase. With an irregular income we often have just as many weeks where we’re short a little money as we do having a little excess money. So, the best thing you can do, is let it roll over. That way when you come to a short week or get a bill that is a little more than anticipated, you’ll be able to use that money to stay caught up.

If you’re fortunate enough to have excess money regularly, I will be doing a post on that in the future. For now, let it ride!

RELATED POSTS

HOW TO MAKE A BUDGET

More to Come!! This is a budgeting series! Don’t forget to sign up for the email list so you don’t miss anything.

JOIN THE COMMUNITY!

DOWNLOAD YOUR FREE BUDGET THERMOMETER

Thanks for stopping by!!

XO,

Morgan

The Cheeky Homemaker

PIN IT FOR LATER

I think everyone that works for the Motion PICTURE studios can use this great budgeting. Thank you.

This is wonderful! We decided to downsize so that we could take early retirement! Budget is our middle name. Love the visual. Keeps us accountable! A definite must try!